Logistics has always been one of the most boring spaces for anyone to startup, the industry is mostly B2B and has little coverage from the media. The very idea of a startup in this space makes one imagine the complexity, the cracky warehouses, the transport fleets yet the market is huge however smart founders have figured out the know-how and have started making inroads to solve the problems. Delhivery is one such company, today Delhivery is a well-established unicorn and the soft bank back startup is planning to go public later this year. In this piece, I will dive a little deeper into the industry, the potential and try to put a comprehensive picture on the rise of the supply chain unicorn.

Overview

Delhivery is a supply chain services company that provides transportation, warehousing, freight, and order fulfilment services. It offers a full suite of services such as last-mile delivery, third-party and transit warehousing, reverse logistics, payment collection, vendor-to-warehouse, and vendor-to-customer shipping. It transforms the logistics industry by utilizing a strategy that enables faster delivery speed, thus decreasing logistics costs which in turn helps e-commerce to thrive.

Market and Background

The Indian logistics sector is valued at USD$ 215 Bn, contributing 14% of the country's GDP and is expected to grow at a CAGR of 10.5% over the next 4 years. The pandemic has been a boon for the sector, once considered as a supporting service sector it has transformed into an essential and mainline sector. A national logistics policy is set to be announced this year which may further boost the industry.

Over the course of years, logistics has been primarily unorganised and prone to delays and uncertainties, with the advent of e-commerce quick, at home, timely delivery became immensely important else it would be difficult to retain customers, for the logistics industry one day or timely delivery were alien things and disruption was required to make ends meet, this changed the course of the industry for good bringing inefficient systems and quicker deliveries.

The next market force was GST, earlier the industry was operating around the premise of minimizing taxes, the warehousing, fulfilment and operations were a function of tax rather than speed, this changed after GST and there has been efficient optimization for speed ever since.

The pandemic has brought the industry to light with the capital flow towards it increasing, we can expect to see many disruptions in the space. Last year alone 452mn was pumped across 40 deals towards startups working in the sector.

Journey and Strategy

“Changing the world, one shipment at a time” - the tagline of delivery is true to its journey and what the company stands for.

Delhivery was started in 2011 by Sahil Barau and Suraj Saharan. Sahil and Suraj ordered food one night from a close-by restaurant which was delivered late upon deliberation with the delivery boy and the restaurant owner they found out the problem with the food delivery system and with the intention to optimize and provide under 30 min delivery they started Delhivery which was then a hyperlocal solution. Later upon the advice of one of their investors, they pivoted into e-commerce and soon forayed into the quest of capturing a large market.

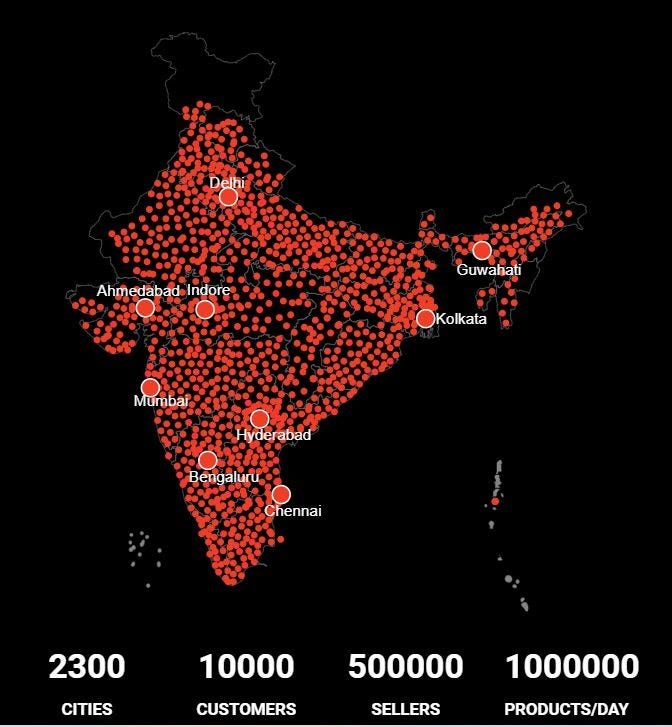

The model was pretty clear as the e-commerce grew in India so the need for efficient deliveries, Delhivery captured this trend right from the start and kept adding pin codes and services to its foray, as the commerce online grew Delhivery became a giant. Today Delhivery operated in 2300 cities and delivers a million deliveries each day

Pricing of the company is similar to any other delivery company, with weight and distance being the key parameters. Delhivery makes a profit on every unit it delivers and is profitable on a unit level. The industry demands infrastructure and people to cater to the demands, Delhivery has successfully built the necessary infrastructure and network which are one time costs that previously affected its profitability, with all the ingredients in place delivery is set to come out big in the coming years.

Business Analysis

Delhivery operates on a B2B model and charges businesses per delivery. The company has 3 major verticals

Warehousing

Transportation

Commerce

The charges for the services are variable depending on the requirement of the businesses. Delhivery's main vertical is transportation. The company has a plug and play model instead of a hub and spoke and has been efficient in optimizing delivery. Delhivery offers last-mile delivery, transit, and third-party warehousing, reverse logistics, vendor to warehouse and vendor to customer, payment collection and shipping. It is similar to logistics companies like FedEx, Bluedart but its niche is e-commerce which contributes to around 20% of the total demand in the logistics market.

Conclusion

Delhivery though profitable on a unit level has suffered losses in establishing the necessary infrastructure to compete in the space, The logistics industry is very large and has been favoured by macro trends in the last few years, The industry is undergoing an overhaul in the country and Delhivery is pretty much leading it. With the IPO expected in the coming months, it will be interesting to see how it competes with the giants.

Being in venture capital I have been seeing many startups coming up in what were considered uncool spaces of logistics and manufacturing, the ecosystem has grown way beyond internet companies, today we have startups disrupting in pretty much every sector available. Our startup ecosystem is maturing and this is probably the most exciting time to startup. Innovation revolution is here to stay. Thank you for reading my blogs, please feel free to give suggestions and feedback. Cheers!!

Sources: Crunchbrace, entrackr, Adlittle, economic times, Ajvc blog, your story, Delhivery website.