Mamaearth is the poster boy for D2C companies in the country, The toxic-free cosmetics company has achieved a remarkable feat of crossing the 100cr turnover mark in just 4 years(to put in in context lotus, Revlon took 20 years to reach that turnover). Mamaearth started as a company providing safe baby care products that are safe by international standards substituting harmful chemicals for natural ingredients in a country where most of the baby products do not meet safety regulations. They have since diversified into skin and hair care products for men and women becoming a complete new-age beauty and personal care brand. In this piece, I will decode the journey and strategy of mamaearth’s success alongside throwing some light on the booming D2C market in India flooded with new-age brands.

Overview

Mamaearth is a clean toxic free beauty and personal care brand that specializes in baby products. Its asia’s first brand to get the MadeSafe certification for its toxin-free products. The company is striving to reduce parental stress and is continually improving and innovating to make the world a safer place for both babies and their parents.

D2C(direct to consumer) refers to selling products directly to customers, bypassing any third-party retailers, wholesalers, or any other middlemen.

Market and Background

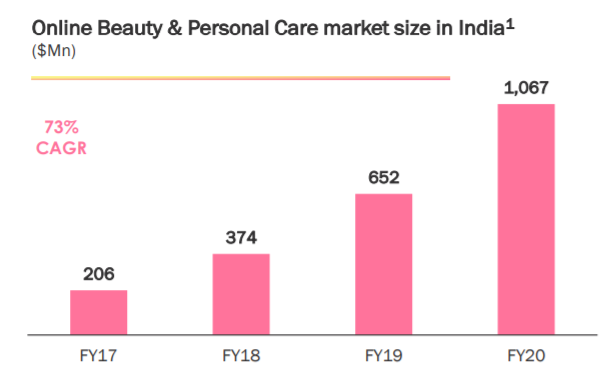

The beauty and personal care market is one of India’s fastest-growing segments, and the Covid-19 crisis has actually been an accelerant in many ways. The growth in this space has been driven by multiple factors such as a shift towards chemical-free and environment-friendly products, growing concerns over personal hygiene leading to high demand for wellness items and the rise of the direct-to-customer model, resulting in agile and customised solutions. The digital-first D2C companies have gained huge traction due to fast product access, safe online shopping and convenient doorstep delivery as the pandemic brought most offline businesses to a grinding halt. The reopening of physical retail has been painfully slow ever since, but e-commerce and digital-first D2C brands have continued to thrive for obvious reasons.

Historically, the penetration of Beauty and personal care brands in Indian was fairly low and limited to those with robust offline distribution networks. The exposure and access to premium products were limited to the larger cities, with the rest of the demographic restricted to the general products available. The increased adoption of eCommerce, accessible internet coupled with the advent of the influencer culture has exposed consumers to products they were once unaware of, creating an urgent demand for them. This has paved the way for this segment to grow rapidly that too when the overall share of eCommerce is just 5.5% of the total.

According to Inc42, the beauty and personal care market in India is expected to reach $37.2 Bn at a compounded annual growth rate(CAGR) of 12.5%. Customers are moving beyond one size fits all concepts and are expecting more personalized products to evolve to meet their needs.

Journey and Strategy

Every D2C brand starts by catering to some consumer need that is not met by legacy brands. This is a structural difference because, in retail, you cannot do that. There will always be some requirements that are not mainstream but are niche and can be fulfilled through the internet. And by catering to this, most D2C brands will start becoming a challenger to established legacy brands on their home turf - be it their core product, market, channels.

When the founder’s Gazal and Varu alagh were expecting a baby, they were browsing through the internet to search for toxin-free safe baby products, after further research they found out that no brand in India provides 100% toxin-free products and most of them do not even meet safety standards, They were disappointed.

“We were worried not only for our baby but for all the kids in our friends' circle. We were able to understand the pain of the parents who despite trying hard could not find a good quality product.” - Varun Alagh

They decided to solve the problem themselves to cater to the needs of the parents who desire organic and natural products for their babies and themselves. This gave birth to mamaearth, which started with 6 products in the baby care range and has now diversified to cater for the adult segment as well.

“We are a 'mum-powered' company and work with a large number of mothers who are involved in the process, right from ideation, conceptualization to the actual product launch. We believe this connection with mothers will continue to be the biggest driver of success. We have more than 200 young moms on board who help us in conceptualizing and formulating the products. The moms then test these products, and only those with great feedback are approved for mass production,” - Ghazal Alagh.

Whats worked for Mamaearth:

-> Superior product quality and awareness about the target audience.

-> lean innovation: continuously using customer feedback to experiment and improve the product.

-> Digital-first, influencer led marketing strategy, putting money where the customer is(90% on digital media, 10% on traditional channels)

-> Strong brand DNA and the understanding of the importance of brand awareness and positioning.

Business Analysis

Mamaearth is a digital-first brand with an omnichannel presence, most of their revenues come from e-commerce marketplaces and their website.

Typically the margins in the beauty and personal care market are around: 65-75% with a potential to raise upto 90%. Average cart size ranges from rs 400- 2000/-

D2C channels help brands keep larger margins for themselves as it gets rid of many middlemen, However, channel commissions for marketplaces like Amazon, Flipkart, Nykaa fall somewhere between 20-40%.

80% of mamaearth’s revenue comes from hair and skincare products and the rest 20% is from Baby care. It has raised a total of $73.3 Mn over the course of 6 rounds and is currently clocking roughly around 500crs in revenue.

Conclusion

Mamaearth’s solid marketing strategy and brand positioning has helped them create a strong brand image across segments. Their unique toxin-free product proposition has helped create a loyal customer base. They should keep building on this base to consolidate their position in the market. The competition in the sector is stiff and the established players will try to dominate the market again with their strong supply chains once the pandemic eases, Mamaearth will have to create a robust omnichannel presence to grow and keep competition at bay.

Sources: avendus, inc42, statuptalky, entrackr, economic times, accel insights, youstory, crunchbase.