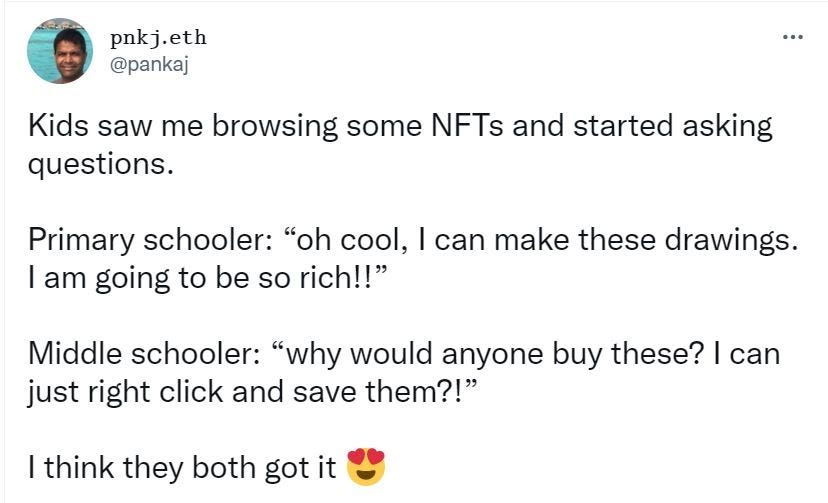

NFT has been a puzzling topic for all of us as it burst into the mainstream this year, pundits, VC’s and crypto enthusiasts are all gaga over it but it is yet to strike a chord with the common man or that artist for whom it is said to be a boon. The VP of Eng at coinbase sums it up cheekily in his tweet:

Messi, sunny leone, amitabh bachan have all launched their own NFT collections to cash in on the digital asset. So what exactly is NFT, how is its worth determined, why are people spending millions acquiring them? Can I get rich by just randomly moving my mouse over the paint sheet! Here in this piece I will dive a little deeper to give you a little context, the concept and the pros and cons of NFT.

What is a NFT?

Non fungible tokens (NFT) are digital assets or certificates for owning goods such as paintings, memes, videos etc. NFT ‘s cannot be replicated or equated with an asset that is similar, because every non fungible token is unique. Fungibility denotes an item or an asset that has the ability to get exchanged with a similar type of asset or good, whereas non-fungible assets tokens are unique digital assets whose ownership can be tracked on say a blockchain. NFTs are digital assets that exist on a public blockchain that serves as a record of ownership. While anyone can view the items, only the buyer of an NFT has the ‘official’ status of being its owner.

For example you have a ticket to CR7’ s debut at old trafford will you accept if i offer to barter it with a movie ticket? No of course not because they both are completely different things and have their own unique identity, that is non fungibility, on the other hand if you have a 100 Rs note and I offer to exchange it with five 20 rs notes you will take it because the value is the same, this is fungibility. Majority of NFTs are held on ethereum blockchain using one of two Ethereum token standards (ERC-721 and ERC-1155) however all other blockchains also support them well.

Like you can exchange a bitcoin for a bitcoin or the money it is worth, whereas you can’t exchange the original mona lisa for the printout you took!

Key characteristics of an NFT: Non Interoperable, Indivisible, Indestructible, Verifiable.

Use cases of NFTs

NFT gives access to an economy centered around blockchain and crypto. They are bringing a revolution to the gaming, art and collectables space. It has given artists a platform to sell artwork in digital form directly to buyers without using an auction house or gallery that allows them to keep a significantly greater portion of the profits they make from sales. Royalties can also be programmed into digital artwork so that the creator receives a percentage of sale profits each time their artwork is sold to a new owner.

You can basically tokenize anything and everything using the technology and even make digital copies of your physical assets, their value however is determined by the market forces like demand, collectability, future sale value etc.

Some more use cases

Tickets: if you create a ticket using NFT there is a record of every transaction of the ticket therefore leaving no chance for counterfeiting, stealing or scalping as there is no chance of replacing the token with anything else.

Fashion: NFTs can be used to keep digital record of authenticity, can be attached with luxury goods to prove its genuinity where non fungible tokens can give information about its origins, materials uses, how far it has travelled to help solve around the issues sustainability.

Collectibles: NFTs can add a touch of authenticity to collectables.

Gaming: NFT allows gamers to own in-game items and power the in-game ecosystem.

Why is so much money being splashed on NFTs?

Well, some people treat them like they’re the future of fine art collecting, and some people treat them like Pokémon cards (where they’re accessible to normal people but also a playground for the mega-rich). The value is determined by factors above the intrinsic factors, imagine art exhibitions. People want to support their fav artists, keep a piece of history (like jack dorsey's first tweet - sold for $2.9 M) or just speculate!

Here below is a great thread on it: Bit.ly/TAS-NFT

Concerns about NFT

It is a speculative asset, the true value of a NFT is very hard to determine. There is no data to suggest whether it is a long term investment or simply a fad!

Digital assets can be copied and it is very difficult to tell whether the NFT seller is the original creator. Your NFT meme or Gif can be reposted n no of times around the internet, one does not control the asset but simply holds a token of authenticity.

Environment Factor: “NFTs Are Hot. So Is Their Effect on the Earth’s Climate”. The sale of a piece of crypto art consumes as much energy as the studio uses in two years. This raises a bigger question about the sustainability of such assets.

Storage: The real NFTs are made and stored through marketplaces and platforms like Open Sea or Rarible. If these platforms get shut, there will be no assurance that one will be able to access it. This makes it less secure than having physical assets that won’t just simply vanish.

There is an amount of regulatory uncertainty regarding NFTs.

The Journey of NFT

In 2012, colored coins made of small denominations of bitcoin which could be used to represent multiple assets were created and marked the ground for NFTs, then came counterplay a peer-to-peer financial platform an open-source Internet protocol built on top of the Bitcoin blockchain. Counterparty allowed asset creation had a decentralized exchange and even a crypto token which was further used by the game creators of Spells of Genesis for their in game ecosystem.

Counterpaty platform continued to be breeding ground for new forms of NFTs including memes in 2016 (Rare Peeps). Then in 2017 etereum stated gaining prominence and the meme marketplace started moving there.

That same year came Cyberpunks, one of the most collectable digital assets to date. They are 10,00 unique characters created on etereum blockchain, suprisingly they were for free and got claimed very quickly, however they were sold and are still selling in secondary market (Cyberpunks were created before the ethereum token standard and are a hybrid of ERC721 and ERC20 protocols)

Later in 2017 with crypto kitties NFTs became mainstream. Crytokitties is a virtual game that allows users to adopt, raise, and trade virtual cats. Cats, on a blockchain. Some cats even sold for over $100k. People were going crazy on the cats and it coincided with the crypto bull run. After seeing the wide scale adoption and spending on the platform investors started to pour in money and people realized the potential of NFTs. Ever since there has been stupendous growth in the NFT ecosystem. 2021 marked a buying surge and is set to be a decisive year for NFTs.

The Future of NFT

Despite the concerns the future looks bright for NFTs, it a $2.5 Bn market which is expected to grow multifold, experts also suggest that more than 40% of new crypto users will start with NFTs.

Should you buy it?

The future of NFT is uncertain and we have little data available to judge their performance. They are new and may be worth investing small amounts into, however it is largely a personal decision.

Sources: nytimes, nasdaq, the verge, a16z, forbes, messari, economic times, the wired, coindesk.