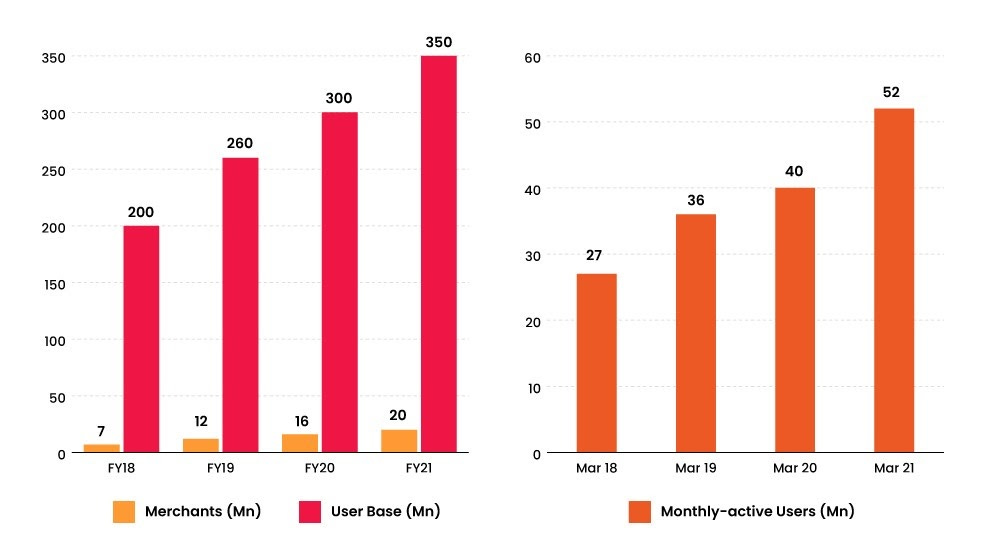

Paytm is set to go public later this year to raise $3bn in what could be the largest IPO debut ever in the Indian capital markets. The payments giant, a subsidiary of one97 communications was started by Vijay Shekhar Sharma in 2010 as a mobile prepaid and recharge platform and has today forayed into every finance sector to become a full-stack super app, it also has an eCommerce vertical Paytm mall. Paytm was the major player who cashed in on demonetization but its shortsightedness to adopt UPI pushed it way back from the top spot, since then Paytm has been focused on expanding horizontally along with consolidating its position in the mobile payment space. The loss-making company according to research firm AllianceBernstein’s has shown financial discipline which is rare in the hyper-competitive payments space and is said to break even in the next 12-18 months, besides its diversified business and revenues streams have been the bullish points for investors. In this piece, I will try to put a holistic picture of the Paytm ecosystem and explain why the giant is a bet for the future.

Overview

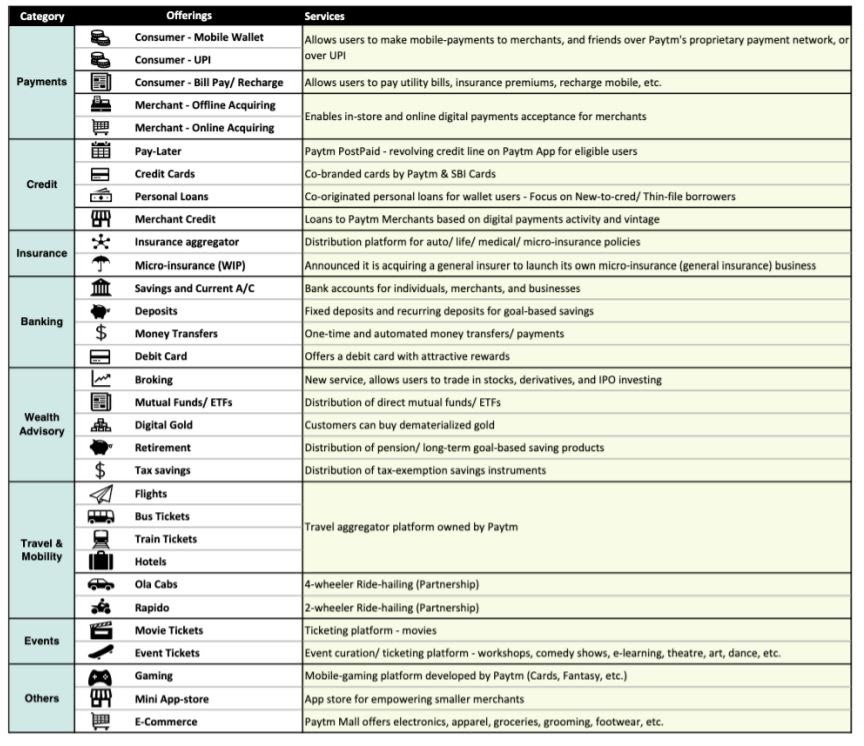

Paytm is a payment gateway that provides payment services to merchants and allows users to make seamless mobile payments. Paytm is a fintech super app providing services in a wide range of use cases and has evolved into a comprehensive payments ecosystem.

Market and Background

The fast-evolving digital payments industry in India, propelled by policy framework, internet and technology penetration, is expected to grow at a compound annual growth rate (CAGR) of 27 per cent during the FY20-25 period (from Rs 2,153 lakh crore in FY20 to Rs 7,092 lakh crore in FY25). The Fintech Market is set to grow at a CAGR of 22.7% during the same period to a $150bn valuation. Favourable regulatory frameworks and India Stack have been the base for this boom. To put it in context India stack has put us way ahead of developing economies in terms of ease of payment and the model is today being studied worldwide for replication, it's a blueprint for economies of the future. To know more you can check out this piece from Tigerfeathers.

Journey and Strategy

One97 Communications started as a prepaid and mobile recharge platform in 2000 by Vijay Shekar Sharma before Paytm was launched in 2010. Paytm is today one of tIndia'sbiggest digital payments companies with digital payments offerings like UPI, credit and debit cards, wealth management through Paytm Money, banking services through Paytm Payments Bank, and more.

Paytm started with the wallet. In absence of any conducive infrastructure, Paytm was a boon for consumers, it acted as a matchmaker between individuals and businesses. It charged nothing from the consumers but levied a 1-2% cut on the merchants. It went after small businesses and due to low ticket sizes, it was difficult for Paytm to generate any significant revenue. It adopted a partnership model with service providers like ola, Rapido alongside for higher ticket sizes.

Post demonetization the company established itself as one of the leading digital payment service providers in the country, however, the shortsightedness to adopt UPI cost Paytm its place. As the company grew Paytm required a heavy influx of capital, the market was very nascent to provide any significant revenue. To date Paytm has raised $2.2 Bn and has forayed into practically every use case available as detailed in the picture above.

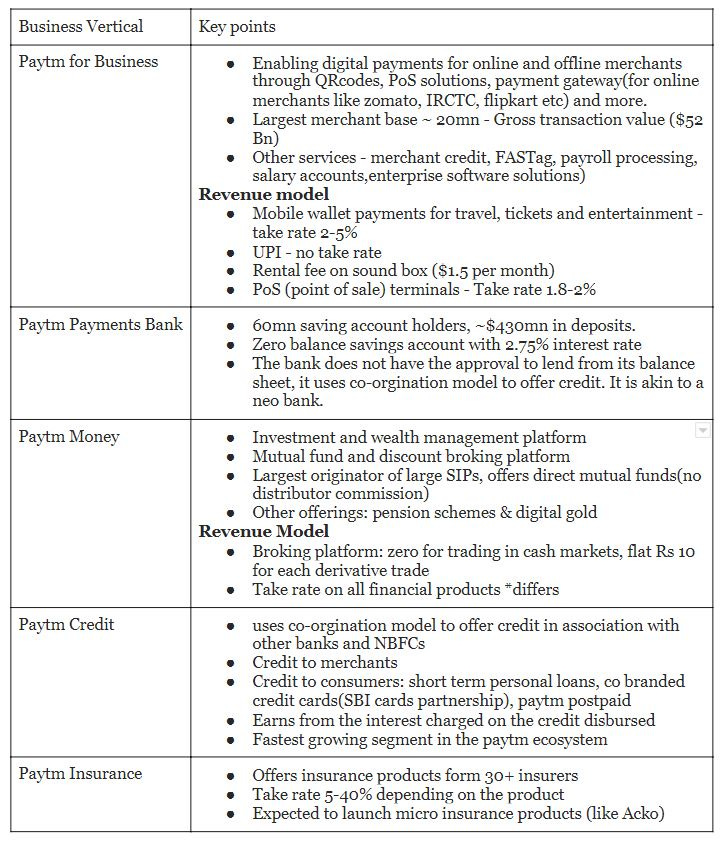

Besides UPI, Paytm focused on services and solutions for the merchant class that need to digitise their payments. The focus on merchants has enabled Paytm Payments Bank to lead the market when it comes to beneficiary bank market share in UPI payments. Paytm has managed to keep its lead in this regard by offering the full stack for UPI payments by owning the issuing and beneficiary bank as well as the UPI app, unlike the two leading UPI apps Google Pay and PhonePe, which rely on third-party banks. This is most evident in the lower failure rate for Paytm when compared to the competitors. Paytm payments bank has seen 2x growth over the last two years and has turned profitable.

One of Paytm’s key strengths is its relatively lower dependence on UPI payments for growth or revenue instead of focusing on UPI, Paytm has focused on more revenue-friendly merchant payments solutions, as well as other services such as Paytm Payouts, Paytm Money, insurance, credit and more. Paytm’s non-payment revenue has grown at a CAGR of 87%(driven by credit, internet commerce) as compared to payments divisions 32%. Paytm is expected to break even on its losses in the next 12-18 months. It has 10-15x more ARPU (average revenue per user) than its competitors.

Business Analysis

Business segments in the Paytm ecosystem

Conclusion

Paytm has done a commendable job so far in acquiring users and providing relevant financial solutions. The verticals that will drive growth are its non-payment verticals which are in novice markets like credit and insurance, how this will pan out and will pay to be able to compete with large verticals players in their niches like Zerodha, groww, policy bazaar is something to watch out for in the future. As of now, we expect a giant IPO later this year.

Sources: Crunchbase, Bloomberg, spirit foundation, AJVC blog, Inc42, Bernstein report, yourstory.

What is the reference for the Business segments analysis and key points?