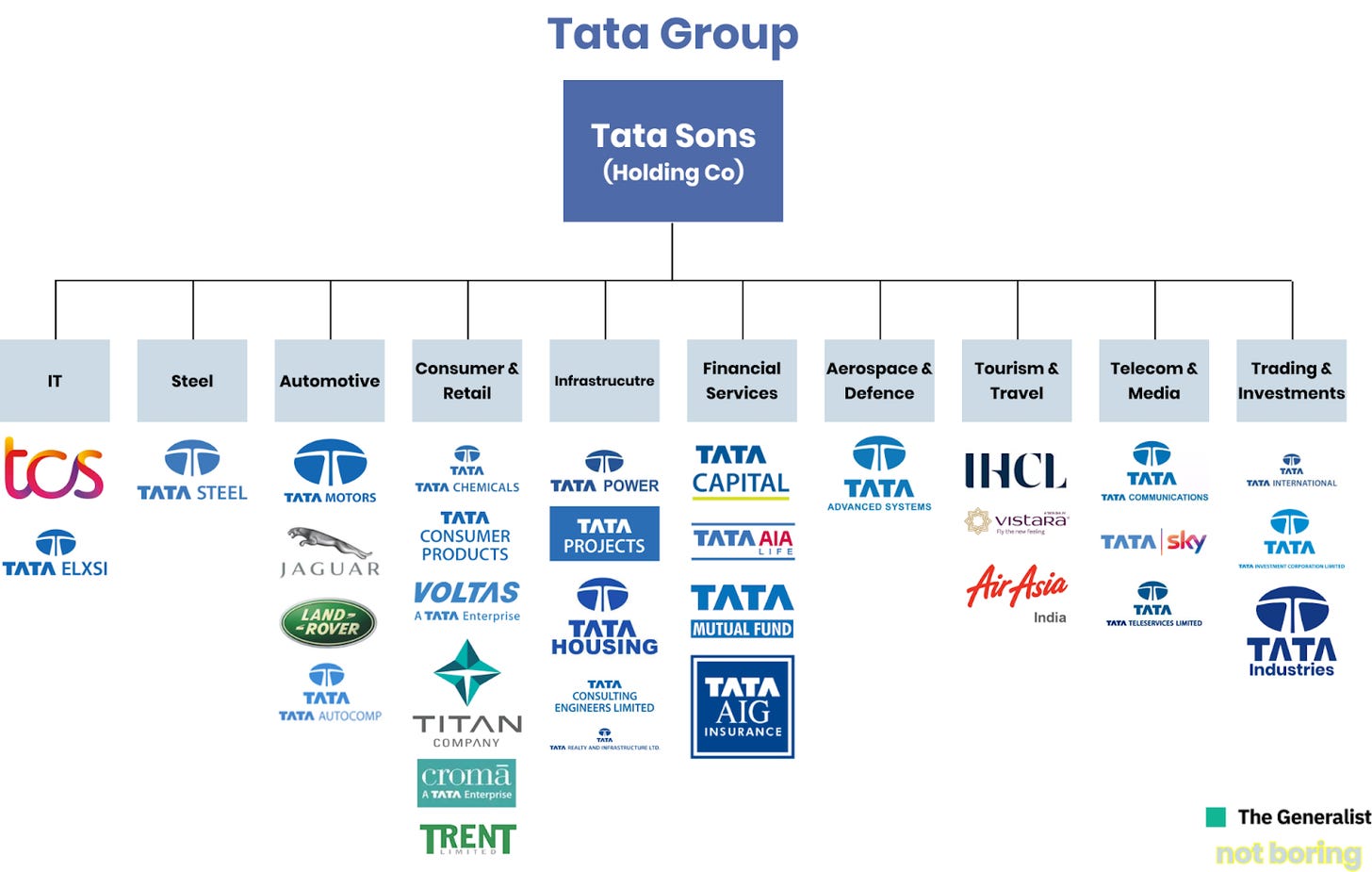

The Tata group has been synonymous with our nation and has over the years been the beacon of trust, the conglomerate has its forays in sectors ranging from energy infra to tourism and IT you name a sector they have a subsidiary, despite the large base, presence across sectors and customer trust in a trust deficit market Tata has been shortsighted in the digital race.

It is not that the salt to software conglomerate does not have an online presence. It has an eCommerce subsidiary Tatacliq and many of its products sell on other online marketplaces but is still to make its presence felt in the digital landscape. will Tata transform and reinvent itself into one of the mightiest companies of this century? all that currently lies in its super app quest, which after setbacks is set to pilot this September. In this piece, I will try to decode the 150-year-old conglomerates’ digital pivot.

What is a Super App?

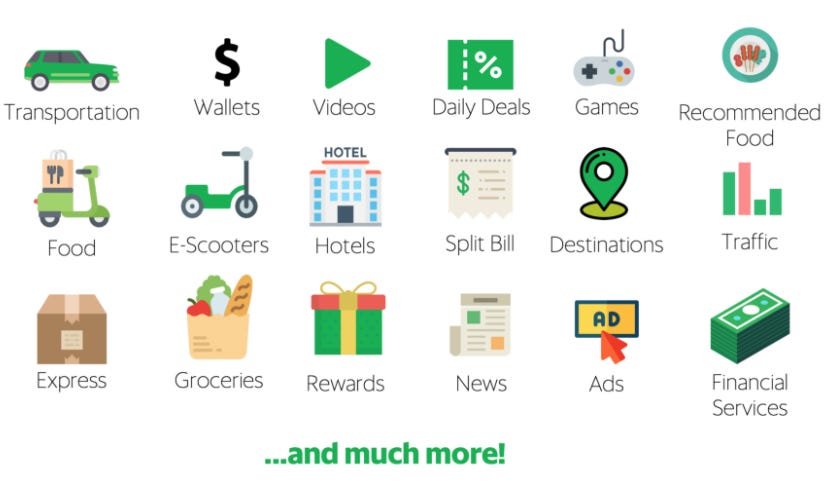

It is pretty much a digital mall, where the customer can get everything they need from the same app - be it groceries, medicines, and much more. The term was coin by blackberry’s founder Mike Lazaridis in 2010 and much to his amazement the first of super apps did not come out from the developed West but from china and south east Asia. Super apps have become widespread primarily in developing economies. Wechat started the trend in china followed by Alipay, Baidu, grab, gojek, Trueid, fave and many more in the SEA region. Amazon in the US, careem in Dubai weigh in as counterparts in developed economies.

Most countries expect India have one or more than one prominent super app, this coupled with the startup boom put in the context of the rapid digitization makes India the perfect hotbed for super apps to evolve. One can argue that we have Paytm and jio which make a strong super app case but we are yet to see it evolve completely as other major players including tata have started to put themselves in the equation.

All of these apps primarily started as chat/ payment/ eCommerce or raid hailing services have gone on to expand their horizons to capitalize more on their existing user base.

Reliance's Jio and Amazon have been aggressively building this for the past few years while others like Paytm, Phonepay, ola, Zee5 are aggressively aggregating to add more to their core services. Here below is the current landscape which is yet to see clear winners.

Why Super App?

India has a large number of first-time internet users and they are mobile-first and use various apps for various requirements, This is one of the main reasons why Indian companies are looking at building super apps. Apart from increased revenue realisation due to consolidation of services at one place, such apps also provide companies large first-party consumer data which can then be used to get more insights on the user behaviour to cross-sell and upsell also this can help create a robust useful rewards ecosystem.

From companies perspective it increases stickiness and widens monetizing opportunities, from a customer’s perspective it reduces the need to download or juggle between various apps saving space and time.

Concerns of a Super App

Super apps may seem convenient on paper but can compromise user experience which is the main driving factor, it will be key to see in the coming year how the ecosystem plays out.

It may lead to the quest of confining the customer to an ecosystem creating potential monopolies.

Privacy is a concern as the master app will be sharing the data with other services provides also the vast amount of data available to the master app can be used to predict user behaviour more accurately which is a major concern and reason why super apps have not emerged in the west.

The Tata Digital Story

Tata is not technically a conglomerate, it has a parent company that owns stakes in its 31 subsidiaries of which 17 are publicly traded. Each company operates independently under its own board of directors. The Tata brand alone is the most valuable in India, with an estimated value of $20 billion and the combined market value of all its subsidiaries is $234 bn. It looks like a corporate mess with an exception of TCS which accounts for 70-90% of its revenues which keeps the debt-laden other subsidiaries afloat. Now, TCS is worth twice as much in the public markets as all of Tata’s other companies combined, and worth nearly as much as all of Reliance Industries on its own. This begs the question of what should tata do to keep itself relevant as till now it does a bit of everything.

The Case of Reliance: Reliance sold 49% of its fuel retailing business to BP for $1 billion and other distressed assets and used the cash to clear the mountain of debt and undertook one of the most aggressive investments in its history by putting $32 billion into Jio’s national 4G network before recently selling stakes to global tech and investing giants. Those investments, plus the asset sales, moved Reliance back to zero net debt, ahead of schedule. Reliance pivot has been based around tech to become a tech-first company for the future.

Now let us get back to tata, during the time when India was going through the digital shift, the tata group was in midst of an internal tussle which ended in then TCS chairman N Chandrashekaran being bestowed the charge to steer tata into a new era. His first task was to organize the 100’s of companies and subsidiaries which he split into 10 verticals under the 3S strategy - simplifying, synergising and scaling. He then formed a new entity Tata Digital to steer the conglomerate into the future.

The group first set out to create their own eCommerce Tatacliq which positioned itself as a premium alternative to existing platforms, long story short cliq never really clicked with the customers despite adopting various strategies.

After deliberation Tata announced its super app plan, a team of its internal leaders was set up and later Mukesh Bansal the founder of myntra and curefit was put at the helm of the digital project. Large amounts of funds were infused and the digital story was set to sail to potion the group as an omnichannel multibrand retail player.

The logic is simple Tata has the brand which carries weight in one of the world’s largest and fastest-growing markets, A repository of tech talent, an internet population that’s expected to reach 1 billion people by 2030, unmatchable distribution and the retail assets. Tata has all-stars aligned and it is natural to look the super app way. Tata though late is not too late to the party, there is still room at the table and a clear winner is yet to emerge.

Reinvention is never easy. One must devise an entirely new way of working, without the reassurance that comes with replicating already existing best practices. This isn’t just about finding a new application for the technology” - N Chandrashekaran

The Super App is one of the biggest bets the group is making to leverage the fourth industrial revolution. As India emerges as a digital nation this pivot will be the key to Tata which has historically managed to reinvest and stay on top.

The Strategy

Tata is following the jio playbook and is set to deploy and also raise funds (~$2.5bn) from different entities to fuel its digital dreams, reliance was smart it both in both Facebook and Google and has since built and acquired companies and products to integrate into the jio ecosystem Tata may now go to collaborate with everyone else and be a counter to the jio force. Reliance stands for verticalization and integration whereas Tata has been decentralized and loose, will it go the control way or follow its DNA is something for the future.

Requirements for a super app: e-commerce, e-groceries, e-pharmacy, fitness and health, hyperlocal and payments.

The acquisitions: Tata Digital has made some wise acquisitions which has helped it make a strong case against the likes of reliance and amazon. Paytm and Hike have already tried their hand through aggregations it’s time to see where the conglomerates lead us. The battle for your screen is ON.

So they have the brand, they have acquired some good assets, they have a hell of a team so what next for the super app, well no one knows much the plan is fairly secretive and a pilot is set for September this year in Bengaluru. It may be an aggregator app, an ecosystem or I don’t know!! This statement from the chairman below which talks of open architecture might give you a fair idea.

“The group has a large consumer base and each of our brands services millions of people. We are trying to connect them and give all products and services they need. Not only Tata products but more. It (Super App) is open architecture. We will have a strong loyalty programme, payments engine, financial products, and a number of other categories, so that it is a compelling value proposition” - N Chandrashekaran

Reliance is building on the jio base, Tata is trying to assemble the titans. reliance needs to figure out execution, Tata needs to figure out integration while a lot of it still remains unclear Tata has played the most audacious consumer play card in the quest to dominate digital India.

Meanwhile, there are apps like shopwise which have integrated the existing players to give a browser-like experience for apps and be a single app for the top 70 apps we use, check that out it may give away a template of what a super app can look like and of course we all have looked at Paytm which is another potential template.

To dominate the Indian market and omnichannel strategy will be critical and whosoever figures it out will run away with the larger pie.. Until next time.. Cheers!!

Sources: Yourstory, Inc42, finology, economic times, the Hindu, Packy macormick, Ajvc blog, E&Y, Techcrunch, Agiletech,

Hmm pretty insightful. Would like to know what you think would be included in the super-app apart from Tata Cliq